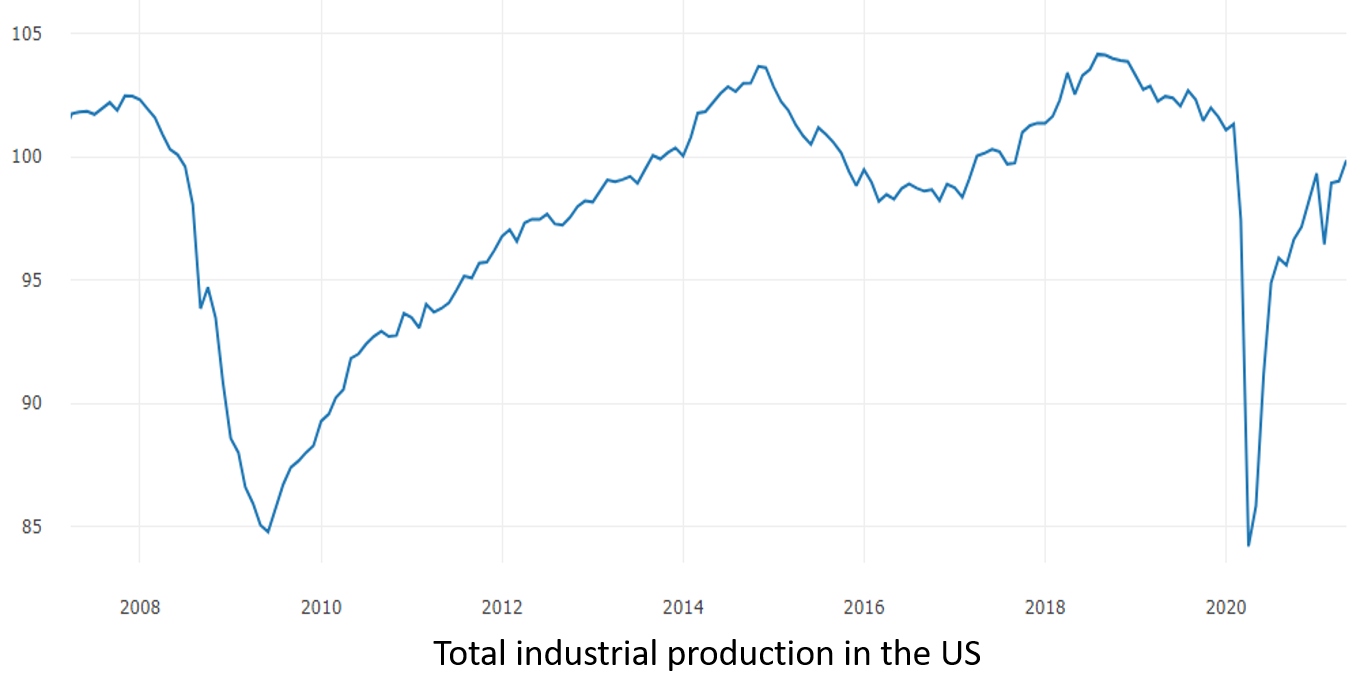

From March 2020 onwards, we have all experienced the effects of COVID-19 and its lockdown on our business. Over the last few months, we saw clear signs of economic recovery across different industries. Initially, a lot of discussion was held on recovery patterns. What to expect? Either a steep and speedy recovery to pre-pandemic levels (V-shape recovery) or a slower and potentially more gradual recovery (U- or L-shaped recovery). For many industries, the recovery has been V-shaped, compared to a longer and more gradual (U-shaped) recovery during the Great Recession. Figure 1 shows this behavior for the overall industrial production in the United States.

The uncertainty on economic impact and recovery patterns led companies to different measures: shutting down production lines, temporary unemployment, laying off people… As the recovery kicked in, many firms were surprised by the sudden uptick in demand. They have held low inventories, canceled raw material supplies, sent their workforce home in order to maintain their cash position. When demand recovered more quickly than anticipated, they faced troubles restarting their global supply chains & fulfilling demand. Companies that have kept their supply chains on hibernation and demonstrated agility in planning & executing a restart, have now a competitive advantage. They are gaining market share over competitors.

Additionally, the restarting of supply chains has been difficult. Not all countries in the world experienced an easing of COVID restrictions at the same time and shipping raw materials between regions is still constrained.

One of those sectors is the automotive sector, where demand for new cars has been above the pre-pandemic levels this year. The restarting of automotive supply chains has not been without hurdles: there is currently a severe shortage of semiconductors. This shortage is a result of auto manufacturers canceling their production during the initial COVID phases and semiconductor producers using this free capacity for other devices that were in higher demand (consumer electronics & IT). On top of that, most of the semiconductor production capacity is located in Taiwan, South Korea, and Japan. Because of COVID flare-ups in those regions, shipping semiconductors from these nations is even more difficult. Lastly, a fire in a major semiconductor factory further worsened the situation.

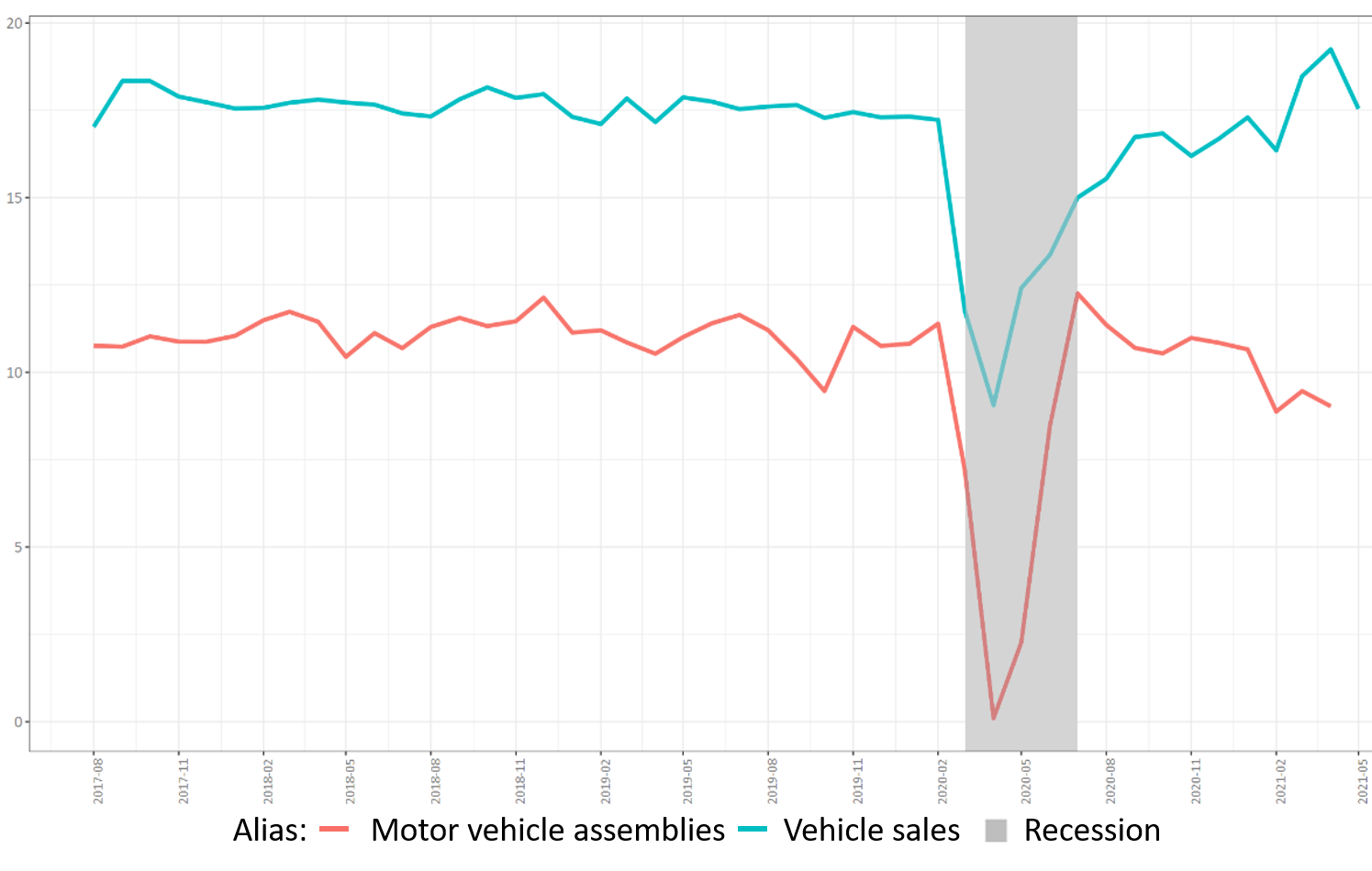

The situation can either normalize soon or might take some months to resolve. We propose to monitor the situation by looking at the macro-economic indicators that capture the demand and supply behavior in the sector. Automotive producers will try to balance production and sales in the longer term. In the case of supply disruptions (such as the case of the semiconductor shortage), it is interesting to monitor this evolution. We chose to monitor two macro-economic indicators. Firstly, vehicle sales is a good proxy for consumer demand and shows a high demand for vehicles in most recent months. The second is the vehicle assemblies as a proxy for the supply of vehicles which shows a low supply of new vehicles. The graphs show a clear deficit between production and sales.

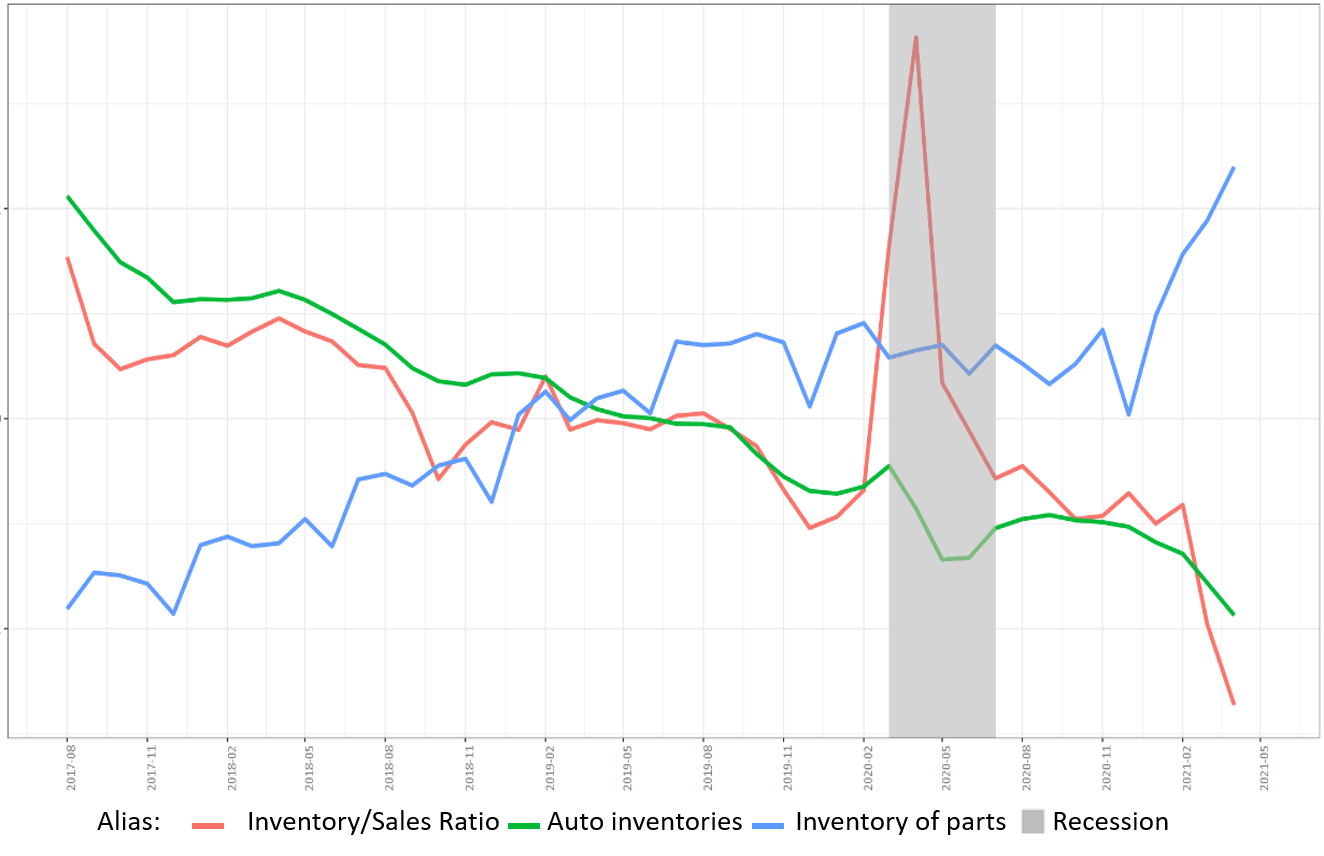

Similar demand-production deficits are typically captured by inventories. In the case of automotive, we see that inventories of finished cars are currently at an all-time low in figure 3. In the inventories of automotive parts, we see the opposite pattern: parts are being manufactured and stored. This indicates the expectation that the shortages will be transitory. Should the shortages last longer than expected there will be massive issues as inventory levels are high with no takers!

How is this situation going to unfold? When is the semiconductor supply to the automotive industry going to normalize? In the meantime, will OEM’s continue to motivate suppliers to build up inventories of parts? One thing is for sure, following up on the changing market conditions is a critical task!

We recommend following up on these market evolutions and act accordingly. To get you on the right track, we created macro-economic dashboards and have notifications available for automotive and other industries. Contact us to gain access to these insights!

The following articles may also be interesting for you:

These Stories on External data