The Central bank of England released its August economic policy outlook which indicates the UK economy might very well enter a period of stagflation. Let’s first look at what stagflation exactly is.

Stagflation is a portmanteau of stagnation & inflation. It refers to the economic situation in which an economy is not growing (stagnation), has high unemployment and high inflation. It differs from a classical recession in the sense that during recessions inflation is typically not out of control due to economic uncertainty that leads to reduced spending (saving for the future). Stagflation is a horror scenario for central banks because it creates a monetary policy dilemma. Central banks need to tighten the monetary policy to reduce inflation, but at the same time want to loosen the policy to stop the recession and increase employment. Let us look at the situation of those 3 components in the UK!

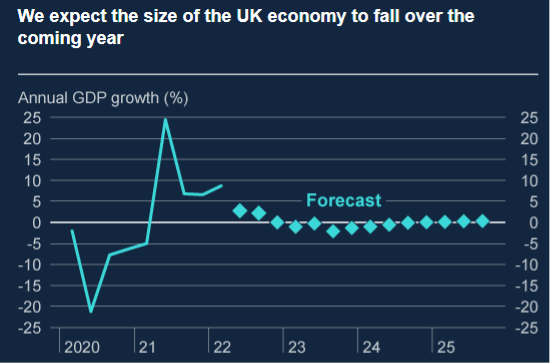

The first component is economic growth. Following the sudden economic contraction in 2020 due to COVID lockdowns, the economy boomed until the start of this year. This year contracted slightly (Q2 showed 0.2% decline in GDP), whereas in Q3 it is expected to grow slightly (0.4%). However, the outlook beyond Q3 is pessimistic: the economy is expected to contract in 2023 by about 2%. Stagflation component 1 seems to be present: slow economic growth or contraction in the near future.

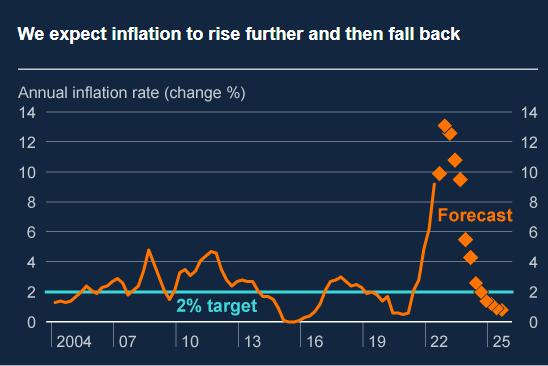

The second component is inflation. We are all well aware we currently have high inflation. But exactly how high? And more importantly, when will it normalize? Central banks of the developed Western world are aiming at keeping inflation at a manageable 2% target rate. This is considered manageable and around the long-term economic growth rate, and keeps negative effects of potential deflation away. Currently the UK is far above the 2% target as it is at 9-10% currently. The bank expects inflation to start to decrease in the fall of next year, while peaking at 13-14% during winter. Stagflation component 2 is present for sure: inflation is and will remain high and above the 2% target according to the central banks estimates.

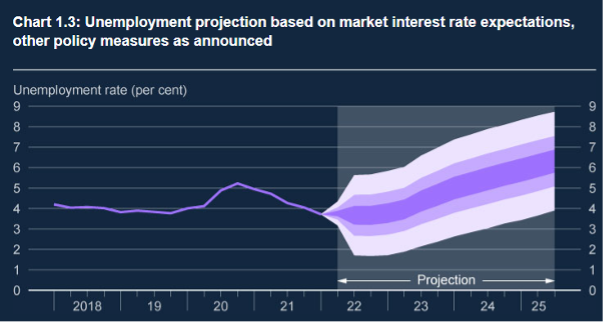

Unemployment increases during the lockdown year of 2020, but afterwards showed strong recovery until the present time. Nowadays, the unemployment is even below the level before COVID. However, the outlook looks less rosy: unemployment is expected to increase in winter and the situation is currently expected to worsen until the end of the projection in 2025. Stagflation component 3 might be present in the future. Currently unemployment is still strong.

In this post we discussed the 3 components of stagflation: a slowing economy with high inflation & high unemployment. Currently we are assessing 2 out of the 3 components are present. The projections made suggest that 2023 could see stagflation occurring.

Unsure which indicators and how indicators are impacting your business? We can help you with that. Monitoring indicators relevant to your business is the first step. A second step is quantitatively determining the impact of indicator fluctuations in forecast models.

Read all about it in our latest Ebook about anticipating sales turning points!

The following articles may also be of interest to you:

These Stories on External data