.png)

The current COVID-19 pandemic is probably one of the highest impact events that we have seen during the past decades as supply chain professionals (and human beings). While some companies are seeing their demand expanding (think about the recent public outcry on toilet paper shortages or the rush on dry food), other industries face a sudden drop in their demand with extreme cases such as the car industry, which is confronted with drops in sales of more than 90%.

It is well known that every S&OP process starts with a good forecast that is used as an input to set inventory targets and organize the supply planning process to achieve strategic business targets. On top of that, a lot of companies start with weekly (instead of monthly) S&OP meetings during crisis times. By consequence, pressure on demand planning teams has never been higher than today.

Developing an accurate forecast typically starts by calculating a statistical forecast that puts several statistical forecasting methods in competition with each other. This way, we select the best performing method for each forecast combination.

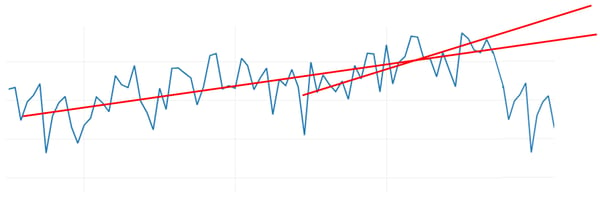

One of the key assumptions, however, behind each of these forecasting models is that the historical demand is a good predictor for future demand. As such, what statistical forecasting does is extrapolate the short or long term trend of the historical sales pattern. The catch here is that external events like the COVID-19 outbreak can never be predicted by simply looking at your own historical data. In this blog you can find out more about the limitations of traditional statistical forecasting techniques.

Traditional statistical forecasting models will extrapolate the short or the long trend.

Traditional statistical forecasting models will extrapolate the short or the long trend.

Therefore, they will never be able to predict a sales turning point.

Does this mean that we should completely disregard statistical forecasting models? Well, the answer is yes and no. Statistical forecasting models could still add value to predict, short term up- or downward trends, but only when the trend is already clearly present for a prolonged period of time in the data. Statistical forecasting - especially in the current economic environment - is simply unable to anticipate the trend and the trend swings.

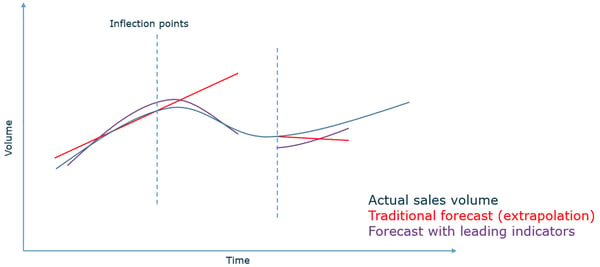

A solution to capture the demand trend and increase the overall forecast accuracy, is to enrich the internal data with external information that looks beyond our own historical sales patterns.

Forecasting sales turning points with indicators that are leading for your business

Forecasting sales turning points with indicators that are leading for your business

To give an example, the impact of the corona virus that Europe is experiencing in the beginning of April 2020, is similar to the impact that China has seen two to three months earlier. Using this insight, we can identify sets of indicators with a two- or three-month lag that could help us to determine our ‘sales turning point’. It can help us to assess where we can expect a further decrease, a slow recovery, a recovery to the previous level, or a bullwhip effect. Complementary to that, we can also study previous extreme events, like the Spanish flu outbreak or the financial crisis that occurred in 2008, and research how this has impacted the demand & sales patterns during that time period. This helps us to further refine the forecast for the future ahead.

Of course, every forecast, even with leading indicators, has limitations. By using external information, we can predict significant sales turning points on an aggregated level. The collaborative component -when it comes to integrating knowledge on the more detailed ‘mix’ level of the forecast- is also key. For example, no model can predict that a certain customer has recently taken a decision to stop ordering for the next X weeks, or, has implemented a new company policy to increase inventories by for example 20% to anticipate a surge in demand.

Let us therefore not abandon collaborative forecasting processes during these turbulent times, but more than ever include key customers in the process. Let's also show our appreciation towards the sales managers and demand planners who are closely monitoring the market and stress the value of collaboration and human input to enrich (statistical and leading indicator) forecasts!

Find out how you can improve your forecasting practices! Outperform your competitors by using quantified market data in your demand planning and learn what drives your sales. In this E-Book we show you how including external market data, improves forecast accuracy tremendously.

These Stories on Demand Planning