Over the last two years I ran into multiple companies that (try to) combine the production of branded and private label goods. Though I haven’t talked to their individual boards or owners, the reasoning seems to be ‘fill the assets’. We have capacity on our production lines, let’s fill these with extra volumes. Basic financials show the profit of the company will go up if the variable costs are covered. Though correct, we’ll use our Supply Chain Triangle to illustrate how challenging this is in practice, and how it may undermine the long-term value of the company.

I refer to two earlier articles on the Supply Chain Triangle and how strategy impacts the balance in the triangle. For the latter I often use a comparison of a hard-discounter like Aldi or Lidl with a traditional supermarket like Delhaize, Albert Heijn or maybe Kroger in the US. Who has the lowest cost? Yes, of course, the hard-discounters. Their primary proposition is the lowest price and to come to the lowest price, they aim for the lowest cost. Who has the lowest inventory? Yes, indeed, again the hard discounters, as they have a smaller assortment. They don’t like a long tail of slow moving products, because the long tail kills efficiency. They focus on the fast moving core, which results in much faster inventory turns. So who has the smallest shops? Same answer. As Delhaize I want to display 15.000 – 20.000 SKU’s I need the physical space to display them. Moreover I know upfront around 20% of them will be fast moving and the rest will sell less frequently. As a result not only do I need more space, but more importantly the net sales per m² will be lower at Delhaize. It doesn’t stop with the shops, it extends into the distribution centers. As everything at Aldi is fast moving, they can cross dock from smaller regional DC’s. Again less inventory, and less investment in DC space.

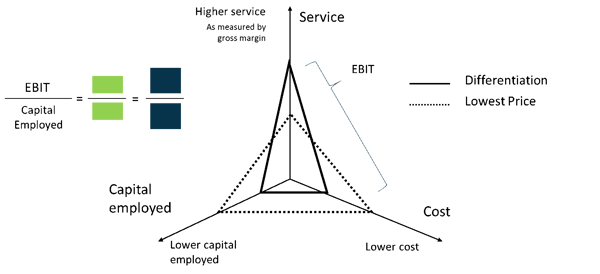

So what does this entail? Well it means the chosen strategy, in this case ‘operational excellence’ for the hard discounters and ‘customer intimacy’ for the traditional supermarket have an important impact on the balance in the triangle. Hard discounters typically work at minimal margins. Why? Because they want to have the lowest price in the market. So, any improvement is translated into a lower price. From an investor’s perspective, the lower margin is fine, as the hard discounter compensates with a lower capital employed. They have less working capital (often negative) and have less fixed assets. As an investor it is equally fine for the traditional supermarket to require more inventory, a higher working capital and a higher investment in fixed assets, if you compensate with a higher margin. As an investor I am concerned with the EBIT generated over the Capital Employed, in financial terms the Return On Capital Employed or ROCE, in spoken language the bang-for-the-buck. So this means different strategies are in fact just different routes to generate the same ROCE. Hard discounters work with minimal margins but compensate with a minimal capital employed. The traditional supermarket requires more capital but, if done well, compensates with a higher margin. This is illustrated in the following graph.

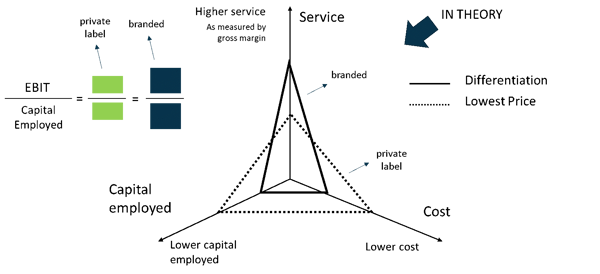

So what does that learn us about combining Branded and Private Label into 1 company and/or 1 supply chain? If we use the terminology of Treacy & Wiersema, branded products are an example of product leadership. Customers buy our product because of a superior quality and we build brands to reinforce and sustain that image. Recent research by Nielsen shows that consumers in this #COVID19 period are resorting more to branded products because of that trusted image. Retailers use private label products to compete with branders on price. Competing on price is operational excellence. So in theory branded versus private label should lead to a different balance in the triangle as illustrated in the following graph.

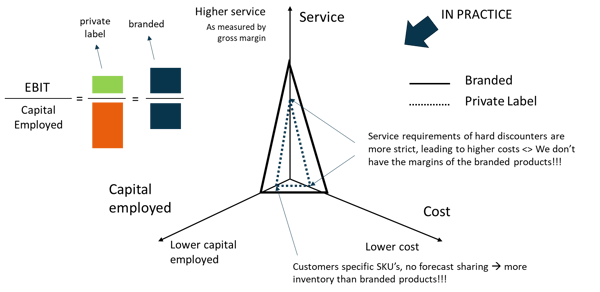

If you (try to) combine branded and private label production into 1 company, I see two things going wrong. First, we often find that the service requirements for private label are more stringent than for branded products and with less information sharing, especially from the side of the hard discounters. However, we don’t have the margins on these products to pay for that. As private label is about customer-specific SKU’s, we typically also carry more inventory. So where the above illustration shows the difference between the two strategies “in theory”, what we often find “in practice” is that private label has a lower margin and requires a bigger investment, so we get less bang for more buck, or we lower the Return on Capital Employed.

Second, Treacy and Wiersema advocate you have to make a choice and be extremely disciplined in executing that choice. Market leaders have what Jim Collins would call a “cult-like culture” that instills the choice and is a requirement for success. Combining operational excellence and product leadership is like sending somebody from Ryanair or Southwest to Etihad. That person will die on the spot. How can you throw money out of the window like that? Or take it the other way around. Send somebody from Etihad to Ryanair. How can you be so rude to your customers? The power of making a choice is twofold. It makes it clear for the customer why they should buy from you. And it makes it crystal clear for all people in your organization on where the focus is, and how we want to stand out in this competitive market. While not making a choice can generate short term contributions to the bottom-line (the volume reasoning at the start of this article). Strategy models like that of Treacy & Wiersema advocate against it from a longer-term focus and value perspective.

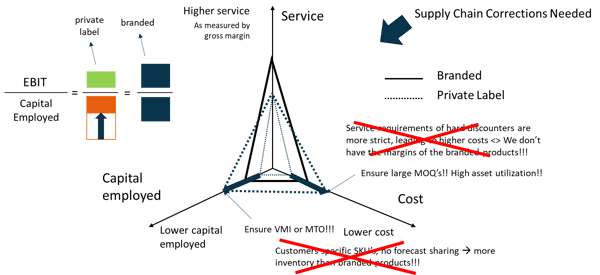

Still we expect Supply Chain people to achieve this: combining Etihad and Ryanair with the same fleet and the same personnel. You need to have strong characters to do so, or maybe split personalities. As Supply Chain you will most probably need to educate your organization on the required balance in the triangle. Instead of keeping inventory for private label products, switch to VMI or Make To Order. I often say “what is that private label inventory doing here in your warehouse … it has the name Carrefour on it, who else is going to sell it”? We’ll need to educate sales and have a different type of discussion with our private label customers. When it comes to asset efficiency, we know we want to have a higher efficiency for the private label products, to compensate for the lower margins. So measure the OEE for your branded versus your private label products, and set different targets. You’ll need bigger volumes, bigger runs and reduced complexity to protect value. Define limits for sales on what is acceptable and what is not. Don't copy the service model of the branded products to the private label business! As shown in the following graph through these measures, you try to balance between margin and capital employed. Remember that in the long run it is not just about volume but it is about value. In many companies it is up to supply chain to stand up and get this debate going.

In the world of supply chain it is popular to talk about ‘segmented supply chains’. After being immersed in the strategy literature, I’m not a big fan. In general my feeling is that supply chain segmentation has been the answer to the wrong question: 'how can we fill the assets'. Whereas the right question is 'how to create long term value'. From the strategy perspective we can say we segment supply chains because of a lack of strategic choices, and the lack of choices has to do with a lack of understanding and a lack of courage. We feel safer being stuck in the middle rather than taking the risk of an explicit choice. It is not me, but the strategy literature that encourages us to do the second. That is what market leaders do, according to Treacy & Wiersema. It is what drives excellence, according to Crawford and Matthews. I’m aware this goes against the flow and the accepted thinking, both in business and in supply chain. That’s why I can only hope it triggers a raging debate that will clarify this intriguing question!

At Solventure, we have invented a new concept called “Strategy-Driven S&OP”. It uses S&OP as your satellite navigation, steering your business towards value along strategically chosen financial targets. Though S&OP has long been claimed as an executive process, many S&OP processes lack the buy-in from the CEO and certainly from their board of directors. We strongly believe our Strategy-Driven S&OP is about to change that.

Read our whitepaper to find out more!

These Stories on Executive S&OP