Optimizing your product portfolio is a strategic effort that can significantly enhance your company’s profitability and efficiency. By accurately assessing costs and aligning them with real-world scenarios, businesses can streamline operations and make more informed decisions.

To help you make this journey, I’ll take you on a deep dive into effective Product Portfolio Management and its crucial role in modern integrated value planning. Step by step, I’ll unveil the "rules of the game", providing you with actionable tactics to overcome common pitfalls.

First, I’ll situate Product Portfolio Management as a critical component of our new vision on S&OP called Integrated Value Planning, or S&OP 2.0.

This vision involves a holistic review of the product and customer portfolios to ensure alignment with strategic objectives, which you can review in detail in our previous blog. I’ll give a short summary on how to achieve Integrated Value Planning here:

In this new vision, balancing the Supply Chain Triangle is still key, as our CEO Bram Desmet has been addressing since his first book in 2018. The way effective portfolio management connects with it, is by ensuring that the product and customer mix aligns with the strategic goals of your company’s integrated value planning. This approach allows your business to make informed decisions based on comprehensive profitability and performance data.

Achieving effective Product Portfolio Management is challenging due to various obstacles, including the complexity of accurately allocating costs and understanding profitability drivers. When I take a closer look at my own customers, several issues pop up regularly:

This is unfortunate, because proactive Portfolio Management can deliver up to 2% of a company’s EBITDA (earnings before interest, taxes, depreciation, and amortization)!

For our vision on winning portfolios, I like to link back to the Supply Chain Triangle created by Bram Desmet. Winning portfolios try to optimize the balance between the three corners of that Supply Chain Triangle:

So, the golden standard regarding portfolios in this context is to achieve a positive evolution on individual products in sales, margin and working capital. Every new product or product range we introduce, we should launch with this ambition. Unfortunately, organizations tend to struggle to reveal which parts of their broader portfolio are contributing to a winning position, which actions they need to take to manage their portfolio, and how they should follow up on those actions and their resulting impact.

And because this balancing act involves every corner of a company, Portfolio Management should always be positioned as a central, cross-departmental function within the organization. It requires collaboration among sales, marketing, operations, and finance to align on strategic goals and ensure consistent implementation of portfolio guidelines.

So how do you achieve a winning portfolio? It all starts with having a clear picture of your active portfolio. Which products are bringing in big profits, and which are adding very little to the profitability of your business?

One way to look at your portfolio is through the overview below. As you see here, the portfolio is structured as a ladder, climbing from the Phase Out zone all the way to the Golden Core. The idea of this visualization is that you should always try to increase the number of our customers and products that are in the winning segment, the triple U segment or golden core, where sales is up, margins are up, and your working capital and fixed asset efficiency (i.e. capital employed efficiency) are up.

The goal of effective Portfolio Management is to move products up. When you can’t stop products from falling, that’s your cue to consider strategies to phase them out, preferably before they drop down to the triple D segment or Phase Out zone. This can be achieved through multiple portfolio actions, such as price increases, drops in costs, efficiency gains, driving volume growth, etc. A phase-out should only be resorted to as a last option.

Understanding relative profitability across the product and customer portfolio is key to compare different products and figure out which of these portfolio actions you should take. Therefore, the quality of the profitability reporting and measures is quite important.

The role of profitability in Portfolio Management is to understand the relative profitability across the product and customer portfolio. To interpret margins correctly you first need to understand how costs are grouped, how the P&L (profit and loss) statement is structured and how costs are allocated to either the product or customer dimension.

To successfully implement portfolio actions, it is then key to have a pragmatic cost allocation approach for different cost components which allow to create a Product Complexity Margin and Customer Margin as addition to the net sales margin based upon standard product cost. This is a topic we discuss in more detail in our whitepaper on Building Winning Portfolios.

Defining clear rules upfront is essential for effective Portfolio Management. These rules include minimum volume and margin thresholds, evaluation periods for new products, and guidelines for collaboration across departments. Agreement on these rules ensures consistency and facilitates smoother implementation:

The best way, in my opinion, to build a successful recurring Portfolio Management process and keep the executive engagement high, is to integrate executive portfolio reviews once every quarter. The goal of the executive portfolio review is to monitor the realization of the portfolio actions and decisions, to analyse the portfolio evolution of the last quarter, and to decide on portfolio actions for the next quarter.

It is up to the process owner of Portfolio Management to prepare the executive portfolio reviews, as well as track and drive progress on the portfolio actions. Every month the process owner should align with the different sales, operations, supply chain & finance stakeholders to ensure progress is made.

And thirdly, the executive team should define a portfolio plan yearly in which clear targets are set for the upcoming budget year, in line with the strategic direction and goals of the company and the role the different product categories have in realizing those ambitions.

The combination of the monthly follow-up, quarterly executive review process and annual target setting creates a stable, recurring and sustained portfolio management process that will form a strong basis for your winning portfolio.

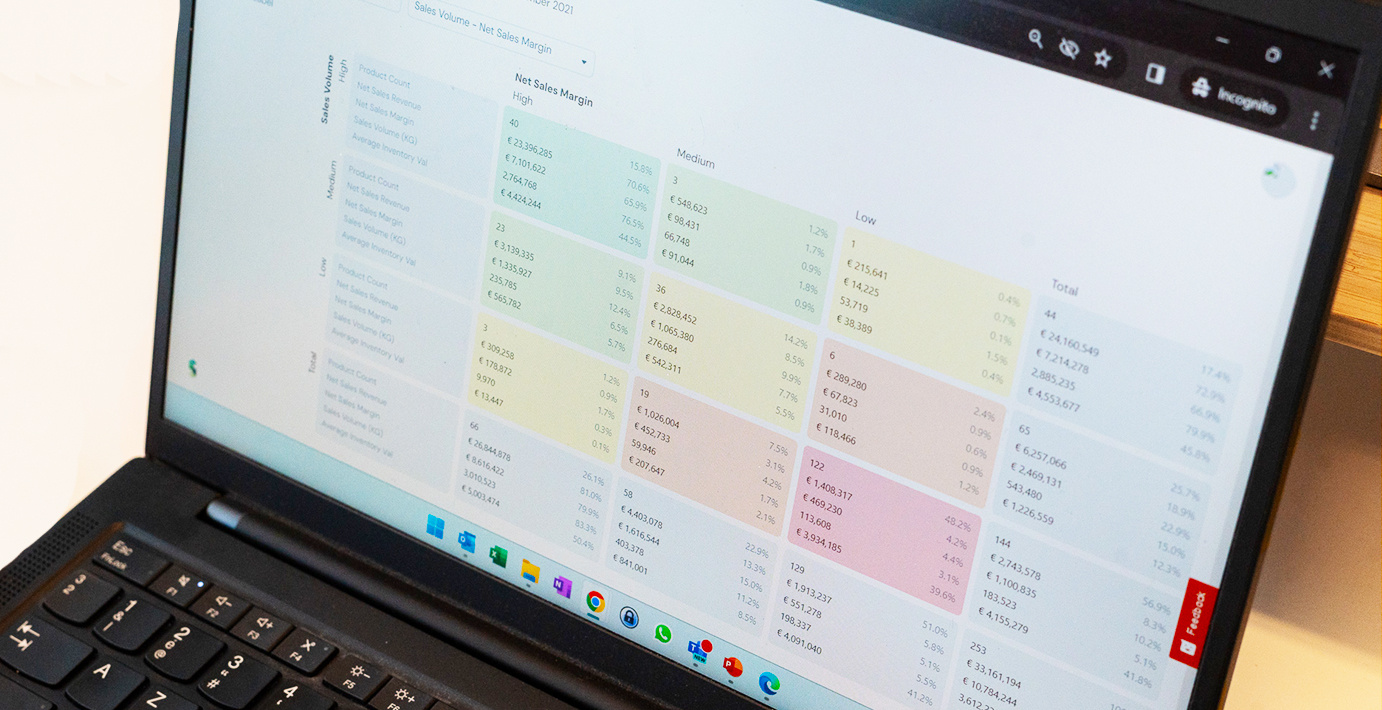

In today's complex business environment, robust tools and data are indispensable. And the same is true for Portfolio Management tooling. To streamline your portfolio management, we offer a Product Portfolio Management Platform: Solventure Perform that:

In the end, Solventure Perform will grow winning portfolios that help improve your corporate performance, allow company growth and strengthen the efficiency of your organization.

To build an effective Product Portfolio Management strategy, businesses should:

By following these guidelines and leveraging advanced tools like Solventure Perform, businesses can achieve a well-managed portfolio that drives profitability, efficiency, and strategic alignment. For further insights, businesses are encouraged to explore the detailed whitepaper on ¨Product Portfolio Management.

These Stories on S&OP