In the current fast-paced world, predicting future trends and making informed decisions is a valuable skill. Businesses, policymakers, and investors constantly seek reliable methods to anticipate market movements, identify potential risks, and seize emerging opportunities. Among the various approaches available, forecasting with leading macroeconomic indicators has emerged as a powerful tool for predicting the trajectory of both companies and markets.

The business environment today is exceptionally volatile due to several factors. Technological advancements, globalization, regulatory fluctuations, and the impact of unforeseen events like the COVID-19 pandemic contribute to business volatility. On top of that the pandemic led to widespread economic shutdowns, supply chain disruptions, market fluctuations, and shifts in consumer behaviour. Additionally, Europe is experiencing the biggest conflict since World War 2 in Russia’s invasion of Ukraine. These factors have contributed to increased uncertainty and volatility in many sectors. Businesses had to adapt rapidly to changing conditions, leading to significant market fluctuations and increased levels of risk.

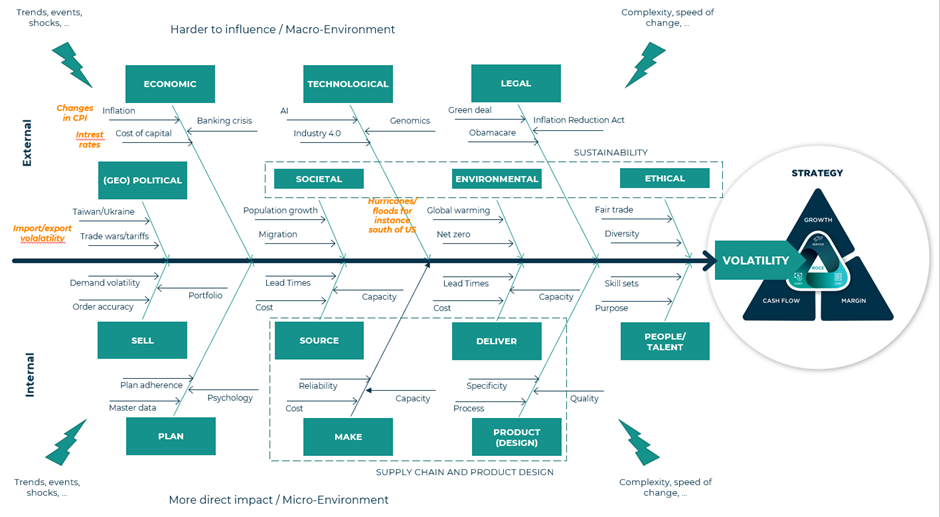

Below is a more detailed overview of factors leading to volatility in companies. We have highlighted quantitative proxies linked to those factors to indicate recent times have become much more volatile.

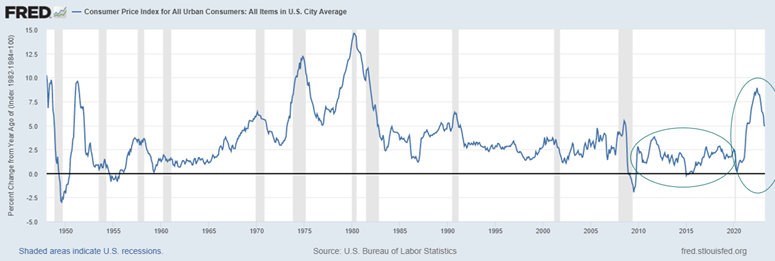

Inflation has been higher than pre-COVID levels, as indicated by the Consumer Price Index (CPI). Supply chain disruptions, increased demand, commodity price hikes, wage pressures, and accommodative monetary policies have contributed to rising prices for goods and services. These factors have impacted households and businesses, highlighting the need for monitoring and informed decision-making in the evolving economic landscape.

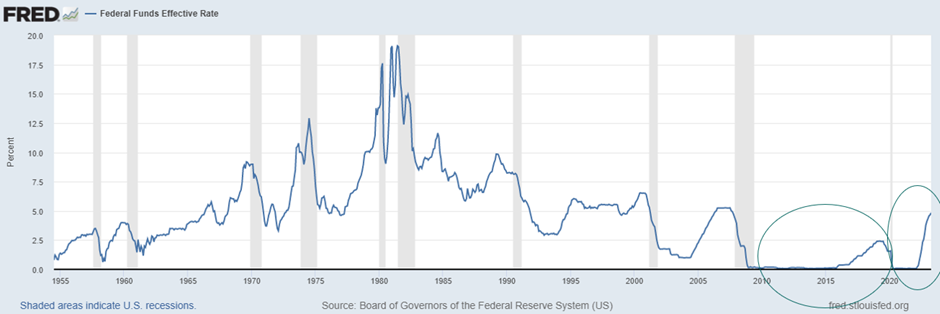

The cost of capital has risen post-COVID, primarily due to changes in interest rates linked to the current high inflation environment. Factors such as central bank policies, increased risk premiums, reduced access to capital, market conditions, and higher demand for funding have contributed to the higher cost of capital.

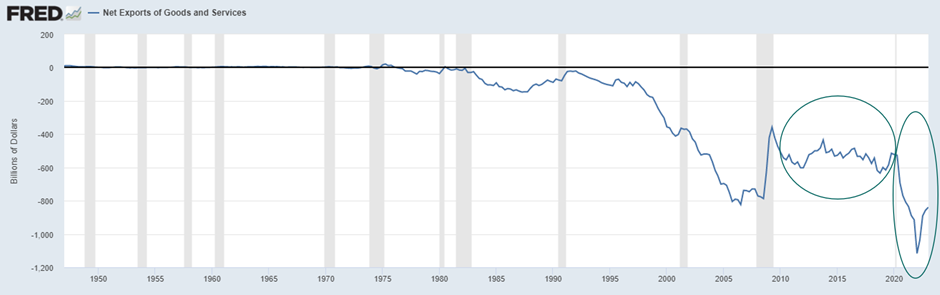

Geopolitical tensions contribute to trade imbalances in the US through tariffs, reduced market access, currency fluctuations, disrupted supply chains, and shifting trade patterns. The graph below shows that these fluctuations have become larger and more frequent.

Previous graphs show that general business volatility has increased since 2020. This most likely translates to volatility in your business as well. The above indicators are general indicators, spanning the broad economy. However, each business has its own set of indicators that are specific for that business. It is essential to follow up upon those and to take them into account in forecasting practices.

Solventure LIFe also assesses how your company sales are correlated with different indicators and which indicators demonstrate a leading behaviour on your sales. These insights allow companies to make a forecasting model that includes evolutions from macro-economic & industry indicators. Companies create a competitive advantage to drive the discussion as part of their Demand Review Meeting (DRM) why the bottoms-up sales forecast aligns or deviates from a macro-economic forecast including these indicators. When inflection points in company sales occur, these models give early warning signals 4 to 6 months in advance. Which sales, marketing or supply chain leader would not hugely benefit of 4 to 6 months of time to anticipate on significant demand changes?

The following articles may also be interesting for you:

These Stories on External data